The BID Rules, Area & Sectors Included

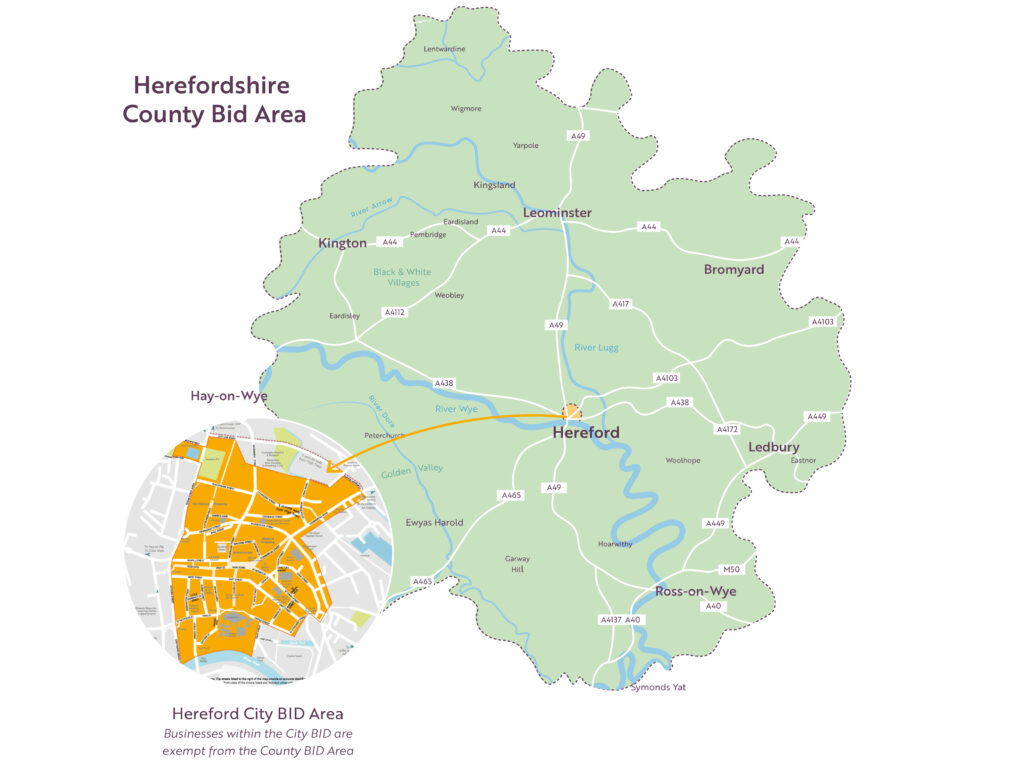

Herefordshire County BID Ltd covers the county of Herefordshire with the exception of the centre of Hereford City, see map below, where businesses are part of Hereford City BID.

BID Levy Rules of Herefordshire County BID Ltd

- The BID Regulations of 2004, approved by the Government, sets out the legal framework within which BIDs have to operate, including the way in which the levy is charged and collected, and how the ballot is conducted.

- The term of the Herefordshire County BID will be for a period of five years commencing on 01 January 2022.

- The levy rate is fixed and will not be subject to variation by the annual rate of inflation.

- VAT will not be charged on the BID levy.

- The BID levy will be applied to all eligible business ratepayers within the defined area.

- The following exemptions to the BID Levy apply:

- Those with a rateable value of less than £12,000

- Retail businesses with a rateable value greater than £100,000

- Businesses whose primary function does not fall into the categories identified (see below)

- Non-retail charities with no paid staff, trading income, arm or facilities and entirely voluntary or subscription based organisations

- The levy will be a fixed rate of 2% based on the rateable value per hereditament as at 1st January each year using the most current Non-Domestic Ratings list. It will be updated for any changes in ratepayer appeals, additions, or removals.

- The BID levy will be paid by any new ratepayer occupying any existing hereditaments (a business rated property) within the BID area.

- New hereditaments will be charged from the point of occupation based on the rateable value at the time it enters the rating list, even though they did not vote on the initial proposal.

- If a business ratepayer occupies premises for less than one year, the amount of BID levy payable will be calculated on a daily basis.

- Empty properties, those undergoing refurbishment or being demolished will be liable for the BID levy via the registered business ratepayer with no void period.

- The BID levy will not be affected by the small business rate relief scheme, service charges paid to landlords, exemptions, relief or discounts prescribed in the Non- Domestic Rating (Collection and Enforcement) (Local Lists) Regulations 1989 made under the Local Government Finance Act 1988.

- Under the BID regulations 2004, Herefordshire Council is the only organisation that can collect the levy on behalf of the BID Company.

- The levy income will be kept in a separate ring-fenced account and transferred to the BID on an agreed basis.

- Collection and enforcement arrangements will be similar to those for the collection and enforcement of non-domestic business rates with the BID Company responsible for any debt write off. The BID area and the levy rate cannot be altered without a further ballot.

- The BID projects, costs and timescales can be altered subject to board approval providing the changes fall within the income and overall objectives of the BID.

- The levy rate or boundary area cannot be increased without a full alteration ballot. However, if the BID company wishes to decrease the levy rate during the period, it will do so through a consultation, which will, as a minimum, require it to write to all existing BID levy payers. If more than 25% object in writing, then this course of action will not proceed.

- The BID Board will meet at least six times a year. Every levy paying business will be eligible to be a member of the BID Company and vote at Annual General Meetings.

- The Board will produce a set of annual accounts available to all members.

The following sectors are part of the Herefordshire County DBID

- Adventure Centre & Premises

- Airfield & Premises

- Amusement Park & Premises

- Aquatic Centre

- Auction Room & Premises

- Auction Rooms, Car Auction

- Site & Premises

- Ballet School

- Bank & Premises

- Betting Shop & Premises

- Bingo Hall & Premises

- Bowling Alley & Premises

- Bowling Club & Premises (Outdoor)

- Brewery & Premises

- Bus Station & Premises

- Cafe & Premises

- Camping Site & Premises

- Car Auction Site & Premises

- Car Park & Premises

- Car Sales & Premises

- Car Showroom & Premises

- Car Wash & Premises

- Caravan Park & Premises

- Climbing Centre & Premises

- Commercial Laundry & Premises

- Communication Station & Premises

- Concert Hall & Premises

- Conference Centre & Premises

- Distillery & Premises

- Equestrian Centre & Premises

- Equine Establishment & Premises

- Field Activity Centre

- Fish & Chip Shop

- Function Venue, Holiday Lets & Premises

- Gallery & Premises

- Gallops

- Game Bird Farm

- Garden Centre & Premises

- Go Kart Track & Premises

- Golf Course & Leisure Facilities

- Golf Course & Premises

- Golf Driving Range & Premises

- Guest House & Premises

- Gym & Premises

- Gym/Fitness Suite

- Gymnasium

- Gymnasium & Premises

- Hairdressing Salon & Premises

- Health & Beauty Salon

- Historic House & Premises

- Holiday Centre & Premises

- Horse Racecourse & Premises

- Hostel & Premises

- Hotel & Premises

- Internet Cafe

- Kennels, Stables & Premises

- Launderette & Premises

- Leisure Centre & Premises

- Library & Premises

- Livestock Market & Premises

- Micro Brewery & Premises

- Motorway Service Area & Premises

- Museum & Premises

- Night Club, Shop & Premises

- Outdoor Activity Centre

- Pavilion & Premises

- Petrol Filling Station & Premises

- Public House & Premises

- Public House Lodge & Premises

- Racing Stables

- Racing Stables & Premises

- Range

- Restaurant & Premises

- Riding School & Premises

- Rowing Club & Premises

- Self Catering Accommodation

- Self Catering Holiday Homes & Premises

- Self Catering Holiday Unit

- Self Catering Holiday Unit & Premises

- Shop & Premises

- Sports Centre & Premises

- Sports Ground & Premises

- Squash Club

- Stables & Premises

- Stud Farm & Premises

- Studio & Premises

- Swimming Pool & Premises

- Tennis Courts & Premises